|

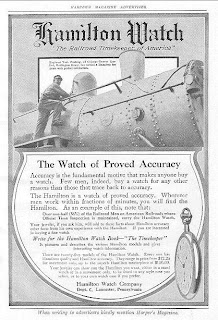

| 1914 Advertisement Harper’s |

New collectors of Hamilton watches have found that the watches for sale on the Internet have come out of estates and garage sales. Gold smelters in the 1970’s destroyed approximately 90% of all wind-up vintage watches. If you see a “production” figure of say 2000 units, then maybe 200-250 of that model remain. Here’s what happened.

After the United States deregulated gold in 1971, the price increased markedly, briefly reaching more than $800 per troy ounce in 1980. From 1980 to 2007, the price has remained in the range of $320 to $460 per troy ounce. The rapidly rising prices of the 1970’s encouraged smelting of anything with gold in it. That meant “gold-filled” watch cases. Why? The gold filled on top of brass and it was significant in amount. Solid gold also laid over brass, but in higher quantities. A $20 used wristwatch became a $200 piece of gold in 1974. My grandfather’s jewelry stores would give a customer a trade in allowance when the surrendered their old watch for a new one. Those watches went into a barrel and prior to 1971, like other Jewelers selling Bulova Accutrons, no one thought anything of it.

Then came the on-rush. A firm called Southwest Smelting had a process for leeching the gold out of those watches. The barrels made their way to downtown Dallas, Texas. Off went what we call vintage watches. Who knew? If I could look into the future, I would have held on to my “used” 1957 Chevy.

Recently, a friend of mine sent her grandfather’s 1930’s Hamilton watch to a relative who pawned it for $10. Maybe the relative didn’t care that it belonged to her great uncle. Hamilton didn’t make that model in solid gold, so the pawn broker didn’t give it much value.(But $10?)

If you reach this entry, leave me a post and I’ll write you back. Don’t pawn it. I promise to offer fair value.

As a courtesy – not an advertisement:

This link will take you to Gold Quote dot Net

Copyright 2006-2017 | All Rights Reserved